Let your vehicle deal with insurance, just fund its wallet and your vehicle

will find the best coverage available, based on your usage, and pay for you.

A concept to disrupt the auto insurance sector in the same way Uber changed the taxi business and AirBnB changed the hotel industry.

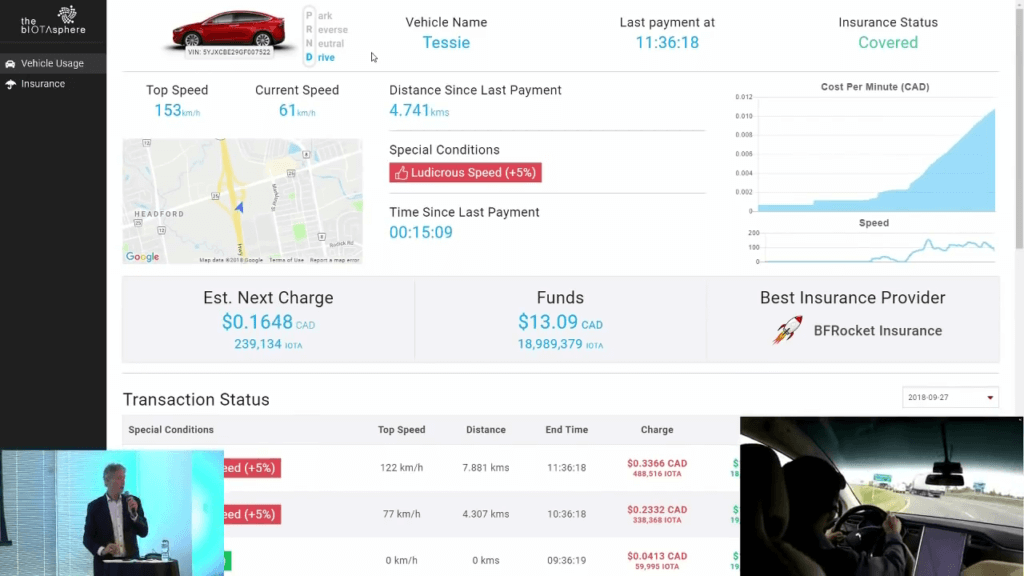

Based on a pay-as-you-drive format, Insure My Car sets up the vehicle as the central point for decision making, choosing which insurance company to contract with for a determined interval with rates based on whether the vehicle is parked, moving slowly or being driven aggressively

The data corresponding to the usage period is made accessible and immutable by writing it to the IOTA tangle.

The insurance payments are automatically taken care of by the car as well using the IOTA currency.

Additional factors can be worked into the system, including time of day, location, traffic conditions, local speed limits, weather, whether the vehicle is self-driving, and more.

The Insure My Car system can be used for a variety of other applications as well, beyond insurance. For example, automatic payments for the usage of city infrastructure or toll roads, ride sharing, product delivery, etc.

To demonstrate the ease of extensibility of Insure My Car, we recently integrated it with a third-party platform called High Mobility, which makes a fleet of virtual vehicles and trip simulators available.

We created a virtual Porsche, a virtual trip in front of the White House, and hooked Insure My Car up to the High Mobility to extract all the real-time usage data as the trip was being simulated.

Our virtual vehicle triggered dynamic switching of insurance policies and even paid for insurance for its virtual trip!

The integration was featured in a webinar hosted by the IOTA Foundation, accompanied by Kevin Valdek (CTO @ High Mobility) and Terry Shane (Founder @ bIOTAsphere).

One of the bIOTAsphere developers that led the Insure My Car project from a technical perspective took some time to discuss the technical details behind Insure My Car.

From the tech stack used to some of the most challenging technical challenges experienced while creating the Proof of Concept.

If you’re interested in the in-depth details behind Insure My Car, take a few minutes to watch Mike Boht answer some community questions asked by Jessa Molyneux.

Conducted by IOTA Hispano

We wanted to demonstrate just how real the technology could be by proving how these tools could impact our lives in the next few years. To make the point, we used a two-year-old production vehicle with no add-ons, hacks, or modifications to show how we could turn an existing business model on its head. Automotive insurance is a ubiquitous product, in an industry that is ripe for disruption and this was a great opportunity to show how new technology could potentially disrupt the space in the next 24-36 months. We’ve seen the taxi and hotel industries caught flat-footed by new models; insurance is the next low-hanging fruit. The demo was intended to be a bit of a wake-up call to the industry but mostly an invitation to forward thinking players to collaborate with us.

These old actuarial models place each of us into large “risk buckets” of statistically-similar drivers, based on attributes that really take no account of the way that individuals within those groups behave. Worse than that, each of us can be “fantastic” or “horrendous” drivers at different times. A great driver who is really late for an important event might make poor decisions that would be out of character 95% of the time. A downtown condo-dweller, might use their car only occasionally, preferring to walk or take transit during the week, but they drive on the weekend to visit family, friends, or just to get away. Despite this, they pay about the same for insurance as their demographically identical neighbor who drives every day

Connected vehicles, that produce large amounts of data in real time, together with other sources of information from mapping services that know what sort of road you are driving on, prior accident history in your current location (so-called “black-spots”), weather conditions, speed limits, hazards, congestion, and so on, provide an opportunity for disruption that many insurance companies are already looking at.

Unfortunately, the approaches that have been used to date are fraught with challenges. In exchange for installing an app or a piece of equipment that lets the insurance company monitor your driving, policy holders are being offered discounts, or non-monetary rewards for “good driving”. These systems have a distinctly “Big Brother is Watching You” feel to them and typically only have a behavior modifying effect for the first month or so, before people forget about them and go back to their normal habits. Many consumers feel that the loss of privacy isn’t worth what they get back in return and the systems are easily fooled intentionally or by accident – a phone app that isn’t disabled can mistakenly track you in a different car, or even on a bus or a plane, when you’re not even the driver.

What if the vehicle could pay for the Insurance as a Service (IaaS) on an hour-by-hour, minute-by-minute, or even on a meter-by-meter basis, instead of the old models where we insure the primary driver and once you’ve chosen the insurance company, you’re locked in for the year?

These were the questions we wanted to explore but above all, in our POC model, it’s the car that is buying insurance and not the owner or the driver (though they may ultimately be funding the car’s wallet). We require no driver information at any time nor do we store information related to the driver so this system is totally respectful of privacy. For the POC, there was no cloud database as all information required to support the coverage was stored in an encrypted format on the IOTA Tangle. This also means that the data would be in a common cross-industry format, and not locked up in a proprietary database, controlled and siloed by a car manufacturer or an insurance company. Please understand though that auto insurance is a complicated industry and we really want to engage with the experts in this field to build a solution that works for everyone. That means automakers, insurers, policy makers, and regulators.

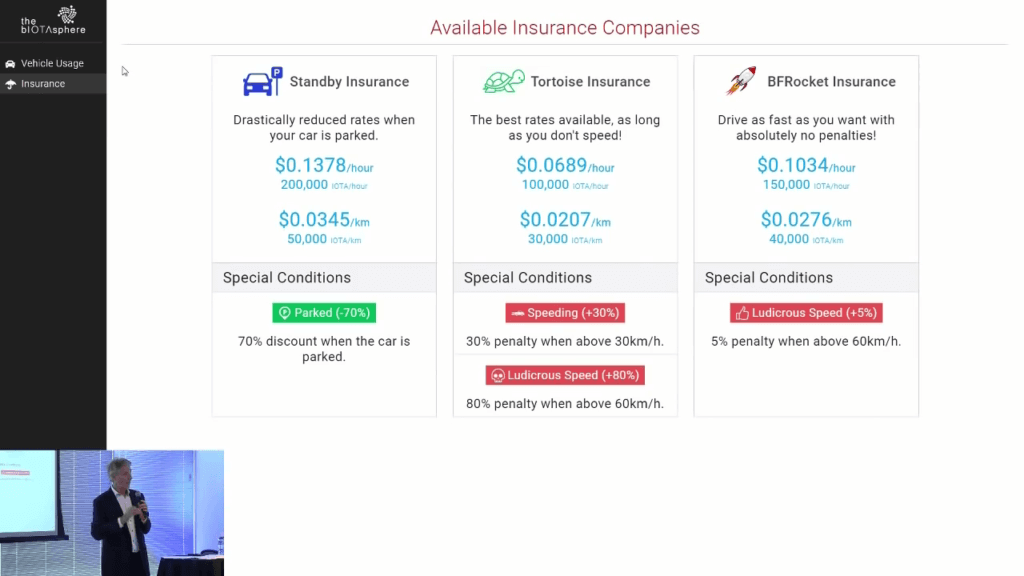

Our three offers were given descriptive names and included Standby Insurance (intended for vehicles that remained in Park for the entire interval), Turtle Insurance (for vehicles that traveled slowly), and BFRocket Insurance (for those who drive fast or aggressively). Each offer could also have so-called modifiers that would add surcharges or provide discounts based on additional parameters – a bit like surge-pricing on Uber. So, exceeding the speed-limit while on the Turtle plan, might increase your rate progressively based on just how much you were exceeding it, but other factors could be included like time of day, weather conditions, road conditions, etc.

Just to be clear, we assumed for our POC purpose, that the car always has some “default” coverage and that the owner is funding the vehicle’s wallet sufficiently to pay for this default coverage. Just like gas, if your tank runs dry the car won’t go! We also assumed that any driver who was at the wheel for the POC was there with the permission of the owner and that they were licensed to drive and not under the influence of drugs or alcohol – not that different from the current model.

A new insurance period could start every minute, every hour, or a some other agreed upon interval but we imagine a world in which there’s a market of dozens or hundreds of offers and the vehicle is constantly selecting the best deal from what’s available. No consumer could ever do this, nor would they want to, since the car is choosing and paying in real time. The solution is especially attractive because it works under the current model of car ownership, but also functions in fleet, car-sharing, ride-sharing and other models too. The vehicle wallet can be funded by the owner, by payments made by passengers or by machine-to-machine transactions as the car performs autonomous services in the future. These future revenue streams might include payments from cargo items, or payments for services such as selling power stored in the car’s battery to a building or another vehicle.

On the flip-side, there is a huge potential for cost savings in this model. A significant portion of your premium today goes to paying for sales and marketing expenses, as well as for the commissions for the intermediaries who typically sell the policies. Additionally, the profitability of a policy premium that insures a parked car could allow first movers in the space to have an unbeatable offer that would leave their competitors scrambling to catch up. Similarly, the profitability of niche offers (such as our fictitious BFRocket offer which charges a high premium for aggressive driving) would allow for hyper-competitive rates for the more reasonable driving periods.

I guess my response to the question would be “can insurance companies afford not to adopt this model in the future as the connected car becomes the rule rather than the exception? New technology changes the logic on which their industry has prospered and they need to disrupt themselves before someone else in the value chain does it for them”

Ultimately, the smart vehicle is going to pay for usage of the infrastructure on a time and distance basis, and the same wallet that is buying insurance, could also be used to pay for the road infrastructure, directly to each of the various jurisdictions in which it was traveling. Pay more for travel on highways than side streets, or based on time of day, or based on road congestion. This is another reason why car manufacturers and insurance companies need to get on-board or at least start experimenting with the technology. There’s lots of money at stake if you represent the conduit that can collect taxes on behalf of the government and do so in a way that is immutable, transparent, and beyond reproach.

In the POC, we don’t know or care who is driving the car beyond the assumption that the person at the wheel is there with the permission of the owner, but if you add a biometric scanner in the car (we’re already using Fujitsu Palm Vein Scanners in our other projects) you could modify the insurance based on what the driver chooses to share without in any way breaching their privacy.

Additionally, you could expand on other things that the car might pay for – charging, parking, car washes, taxes, tolls, use of HOV or Premium Travel lanes. We’d like to really use this opportunity to engage with the various stakeholders to start a new conversation and to create new possibilities. We don’t have all the answers but we do know how to ask great questions!

I can’t say much more than that; it’s still very early in what will be a long process but the people we’ve spoken to are intrigued with the fundamentally different approach we’ve taken and are interested in exploring the ideas further.

For now, let’s just say that public announcements often come much later than all the hard work that has to go on behind the scenes, laying the foundations upon which you can build. I’d rather deliver something real than focus on hype, which typically only leads to disappointment, since reality rarely lives up to our “sweet imagination”.